How to File Taxes in South Korea as a Foreign Resident

Navigating the tax system in South Korea as a foreign resident requires a clear understanding of the country’s tax regulations, filing procedures, and compliance requirements. Whether you are employed, self-employed, or earning income from other sources, it is essential to determine your tax residency status, understand your obligations, and take advantage of any applicable deductions or exemptions. This guide provides a detailed overview of the tax filing process for foreign residents in South Korea, helping you ensure compliance while optimizing your tax situation.

Determining Your Tax Residency Status

South Korea classifies individuals as either residents or non-residents for tax purposes. Your residency status determines your tax obligations and whether you are subject to taxation on worldwide income or only South Korean-sourced income.

Resident vs. Non-Resident

|

Resident |

Non-Resident |

|

A foreign individual who has lived in South Korea for 183 days or more in a given tax year or has their primary economic center in the country. Residents are subject to global taxation, meaning they must report both domestic and foreign income. |

A foreign individual who stays in South Korea for less than 183 days in a tax year. Non-residents are taxed only on income derived from South Korean sources and are not required to report foreign income. |

Residency Verification

Residency is typically determined based on immigration records, lease agreements, employment contracts, and financial transactions. If you frequently travel in and out of South Korea, the National Tax Service (NTS) may assess additional factors to determine your residency status.

Understanding Taxable Income

Foreign residents in South Korea are subject to income tax on various types of earnings.

Types of Taxable Income

- Employment Income – Salaries, bonuses, and allowances from employment.

- Business Income – Income earned by self-employed individuals or freelancers.

- Rental Income – Income from leasing residential or commercial properties.

- Capital Gains – Profits from the sale of real estate, stocks, or other assets.

- Dividend and Interest Income – Earnings from investments, including stocks and bank deposits.

- Pension and Severance Pay – Retirement benefits and lump-sum severance payments.

- Other Miscellaneous Income – Prizes, royalties, and one-time payments.

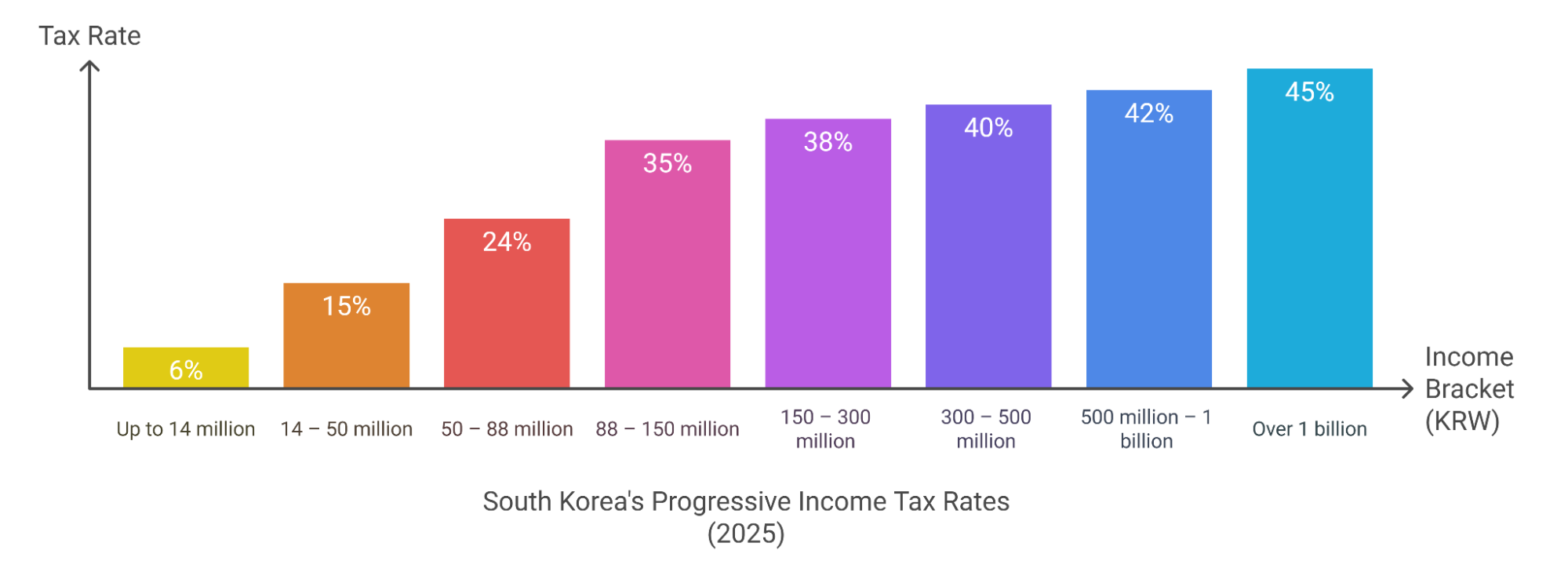

Progressive Income Tax Rates (as of 2025)

South Korea applies a progressive tax rate on employment and business income:

|

Annual Taxable Income (KRW) |

Tax Rate |

|

Up to 14 million |

6% |

|

14 – 50 million |

15% |

|

50 – 88 million |

24% |

|

88 – 150 million |

35% |

|

150 – 300 million |

38% |

|

300 – 500 million |

40% |

|

500 million – 1 billion |

42% |

|

Over 1 billion |

45% |

Additionally, a local income tax of 10% is applied on the national tax amount.

Filing Methods and Deadlines

Foreign residents can file their taxes through different methods depending on their employment type and income sources.

Employer Withholding (For Salaried Employees)

Most employees have their taxes deducted by their employer under the year-end tax settlement (ì—°ë§ì •ì‚°, Yeonmal Jeongsan) system.

- Filing Deadline: End of February of the following year

- Process: Employers submit tax documents on behalf of employees, who may need to submit additional documents for deductions and credits.

Self-Filing (For Self-Employed and Other Income Earners)

Self-employed individuals and those earning additional income must file their own tax return (종합소ë“세 ì‹ ê³ , Jonghap Sodeukse Singo).

- Filing Period: May 1 – May 31 of the following year

- Submission Method: Online via or in person at the local tax office.

Special Tax Programs for Foreigners

Certain expatriates qualify for a 19% flat tax rate instead of the progressive tax rates, available for up to 20 years for foreign employees in specific industries. Application for this special rate must be made at the time of filing.

Tax Deductions and Credits for Foreign Residents

Foreign residents can claim various deductions and tax credits to reduce taxable income.

|

Standard Deductions |

Tax Credits |

|

|

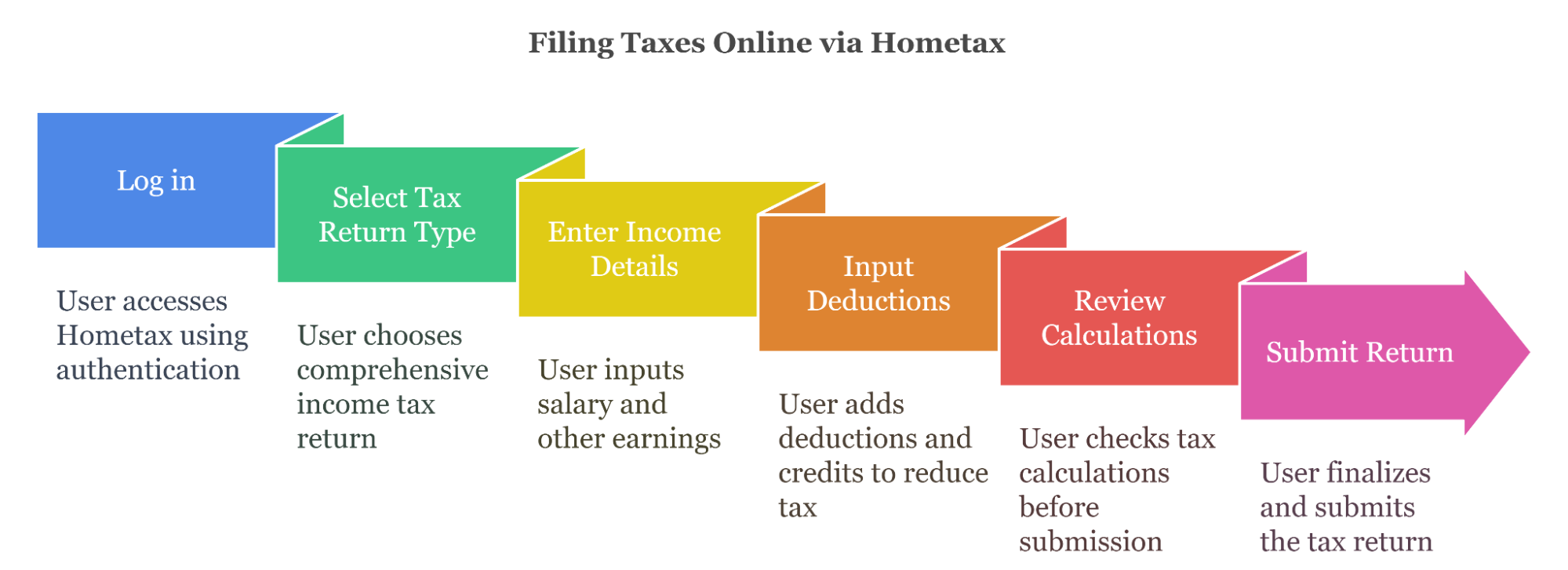

How to File Taxes Online via Hometax

Foreign residents can file taxes electronically using Hometax (www.hometax.go.kr).

Step-by-Step Guide

- Log in using a Public Key Certificate or mobile authentication.

- Select "Comprehensive Income Tax Return" (종합소ë“세 ì‹ ê³ ).

- Enter income details, including salary and other earnings.

- Input deductions and credits to reduce taxable income.

- Review tax calculations and submit the return.

- Pay taxes via online banking, credit card, or bank transfer.

Consequences of Non-Compliance

Failing to comply with tax obligations in South Korea can lead to serious financial and legal repercussions. The National Tax Service (NTS) actively enforces tax laws, ensuring that both residents and foreign nationals meet their filing and payment responsibilities. Some of the key consequences of non-compliance include:

- Late Filing Penalties: Taxpayers who fail to submit their returns on time may face penalties of up to 20% of the unpaid tax amount, depending on the severity and duration of the delay.

- Interest Charges: Any overdue tax amount accrued daily interest until fully paid, increasing the overall liability.

- Criminal Prosecution: In cases of deliberate tax evasion, such as falsifying income records or hiding financial assets, offenders may face criminal charges, leading to fines or even imprisonment.

- Restrictions on Future Transactions: Unresolved tax issues can result in restrictions on conducting business, renewing South Korea visas, or engaging in financial activities within South Korea.

- Tax Audits and Additional Scrutiny: Non-compliance can trigger a tax audit, subjecting individuals or businesses to increased scrutiny, further penalties, and potential reputational damage.

Seeking Professional Assistance

Understanding and navigating South Korea’s tax system can be complex, especially for foreign residents unfamiliar with local regulations. To ensure compliance and optimize tax benefits, hiring a certified tax accountant (세무사, Saemusa) is highly recommended.

A professional tax consultant can assist with:

- Ensuring Compliance: Avoid penalties by accurately filing tax returns and meeting deadlines.

- Maximizing Deductions: Identify eligible tax deductions and credits to reduce your overall tax liability.

- Simplifying the Filing Process: Handle documentation, reporting, and submission, saving time and effort.

- Providing Expert Guidance: Stay informed about tax law changes and receive tailored advice based on your residency and income status.

Importance of Tax Compliance for Foreign Residents in South Korea

Understanding and fulfilling tax obligations in South Korea is essential for foreign residents. Compliance not only ensures financial and legal security but also provides various benefits. Here’s why tax compliance is important:

- Avoiding Penalties and Legal Issues:Failure to file taxes or underreporting income can lead to hefty fines, interest charges, audits, and even criminal prosecution in severe cases. The National Tax Service (NTS) actively monitors compliance, making accuracy and timely filing crucial.

- Maintaining Visa and Residency Status:Tax compliance is often linked to visa renewals and business permits. Unpaid taxes or unresolved issues could result in restrictions on work permits, residency extensions, or business operations in South Korea.

- Maximizing Tax Benefits and Deductions:Foreign residents may qualify for various deductions and exemptions, including housing costs, pension contributions, and dependent allowances. Proper tax filing ensures that you don’t miss out on these benefits.

- Establishing Financial Credibility:A good tax record helps with loan approvals, business investments, and financial transactions in South Korea. Non-compliance may negatively impact your financial standing with banks and institutions.

- Contributing to Social Security and Benefits:Paying taxes supports public services, healthcare, and pension systems, some of which foreign residents can access. Compliance ensures that you contribute to and benefit from these programs.

Frequently Asked Questions (FAQs)

Do foreign residents have to pay taxes in South Korea?

Yes, foreign residents who earn income in South Korea are subject to taxation. Depending on your residency status, you may be taxed only on income earned within Korea or on your worldwide income.

How do I determine my tax residency status?

You are considered a tax resident if you stay in South Korea for 183 days or more within a tax year or have a primary residence in the country. Non-residents are only taxed on their Korean-sourced income.

What happens if I fail to file my taxes on time?

Failure to file taxes or underreporting income may result in late penalties (up to 20% of unpaid tax), interest charges, audits, and even criminal prosecution for severe tax evasion cases.

Can I claim tax deductions as a foreigner?

Yes, foreign residents may be eligible for various tax deductions, including those for housing expenses, dependents, and pension contributions. However, eligibility depends on your residency status and specific tax agreements.

Should I hire a tax professional to handle my taxes?

If you are unfamiliar with South Korean tax laws, hiring a certified tax accountant (세무사, Saemusa) is advisable. A professional can ensure compliance, maximize deductions, and simplify the filing process.

Disclaimer: Although this information was last updated in February 2025, we recommend verifying with the appropriate agencies, embassies, and airlines to ensure complete accuracy regarding your travel plans.