How to Open a Bank Account in South Korea as a Foreigner

Opening a bank account in South Korea is a crucial step for foreigners living, studying, or working in the country. Whether you need an account for salary payments, daily transactions, or international money transfers, understanding the process and requirements will help you open one smoothly. While South Korea has a well-developed banking system with many digital services, some banks have strict policies for foreigners.

This guide covers everything you need to know, including eligibility requirements, necessary documents, choosing the right bank, and tips for a hassle-free experience.

Types of Bank Accounts In South Korea

Banks in South Korea offer different types of accounts depending on financial needs.

Common Account Types

- Basic Savings Account: Used for everyday transactions, deposits, and ATM withdrawals.

- Salary Account: Required for receiving salary payments; some employers may require accounts at specific banks.

- International Transfer Account: Needed for sending and receiving money from abroad. Some banks impose a three-month waiting period before allowing international transfers.

- Fixed Deposit Account: Offers higher interest rates for long-term savings.

- Business Account: Designed for corporate transactions, requiring additional documentation.

Eligibility Requirements For Opening a Bank Account

Foreigners can open a bank account in South Korea, but the services available depend on their South Korea visa status and residency.

Who Can Open a Bank Account?

|

Eligibility |

Details |

|

Foreigners with an Alien Registration Card (ARC) |

Those holding a long-term visa (such as a work, student, or spouse visa) and an ARC can open a full-service bank account. |

|

Short-Term Visitors (Tourists & Visa-Free Travelers) |

Some banks allow tourists to open limited-function accounts without online banking or international transfers. |

|

International Students and Workers |

Many banks accept proof of enrollment or employment as an alternative to the ARC for students and workers who have recently arrived. |

|

Business Owners and Investors |

Foreign entrepreneurs can open corporate accounts but need to provide additional business-related documentation. |

Required Documents For Opening a Bank Account

To open a bank account in South Korea, you must provide the necessary documents for identity verification and compliance with financial regulations.

Mandatory Documents

|

Requirements |

Detail |

|

Valid Passport |

Required for identity verification. |

|

Alien Registration Card (ARC) |

Essential for long-term residents. Some banks allow accounts with only a passport, but with restrictions. |

|

Korean Phone Number |

Needed for SMS verification, mobile banking registration, and online transactions. |

|

Proof of Residence |

A lease agreement, utility bill, or an employer/school-issued document confirming your Korean address. |

Additional Documents (Depending on Bank and Account Type)

|

Requirements |

Detail |

|

Certificate of Employment |

Required if you are working in Korea; some banks may ask for proof before allowing salary deposits. |

|

Student ID or Certificate of Enrollment |

Required for students opening an account. |

|

Income or Tax Statement |

Some banks require proof of income for accounts with high transaction limits. |

Online and Mobile Banking in South Korea

Most South Korean banks offer online and mobile banking services, but as a foreigner, setting up digital banking may require additional steps.

Features of Mobile Banking in South Korea

- English-Friendly Apps: Some banks, such as KB Kookmin and Shinhan, offer English-language mobile apps to assist foreign customers.

- Korean Phone Number Required: A local phone number is necessary for SMS verification and app activation.

- In-Person Verification: Certain banks require foreigners to visit a branch for identity verification before activating online banking services.

- Security Software: Many banks mandate the installation of additional security software for secure online transactions.

If you are not comfortable using Korean-language banking apps, consider choosing a bank that provides better English support.

Initial Deposit and Account Fees

Before opening a bank account, be aware of the associated costs and fees:

- Initial Deposit: Some banks require an initial deposit, while others may not.

- Account Maintenance Fees: Basic accounts typically have no monthly fees, but premium accounts may include charges for extra services.

- ATM Withdrawal Fees: Fees may apply for using out-of-network ATMs or making withdrawals outside of business hours.

It is advisable to check your bank’s ATM withdrawal limits and overseas transaction fees if you plan to use your account abroad.

International Money Transfers

If you need to send or receive money from abroad, consider the following factors:

- Bank Wire Transfers: Some banks impose a waiting period before allowing international transfers for new accounts.

- Exchange Rates: Banks may offer less favorable exchange rates compared to third-party remittance services.

- Processing Time: International transfers usually take between one to three business days to process.

- Alternative Services: Platforms such as Wise (formerly TransferWise), Revolut, and PayPal may provide lower fees and better exchange rates.

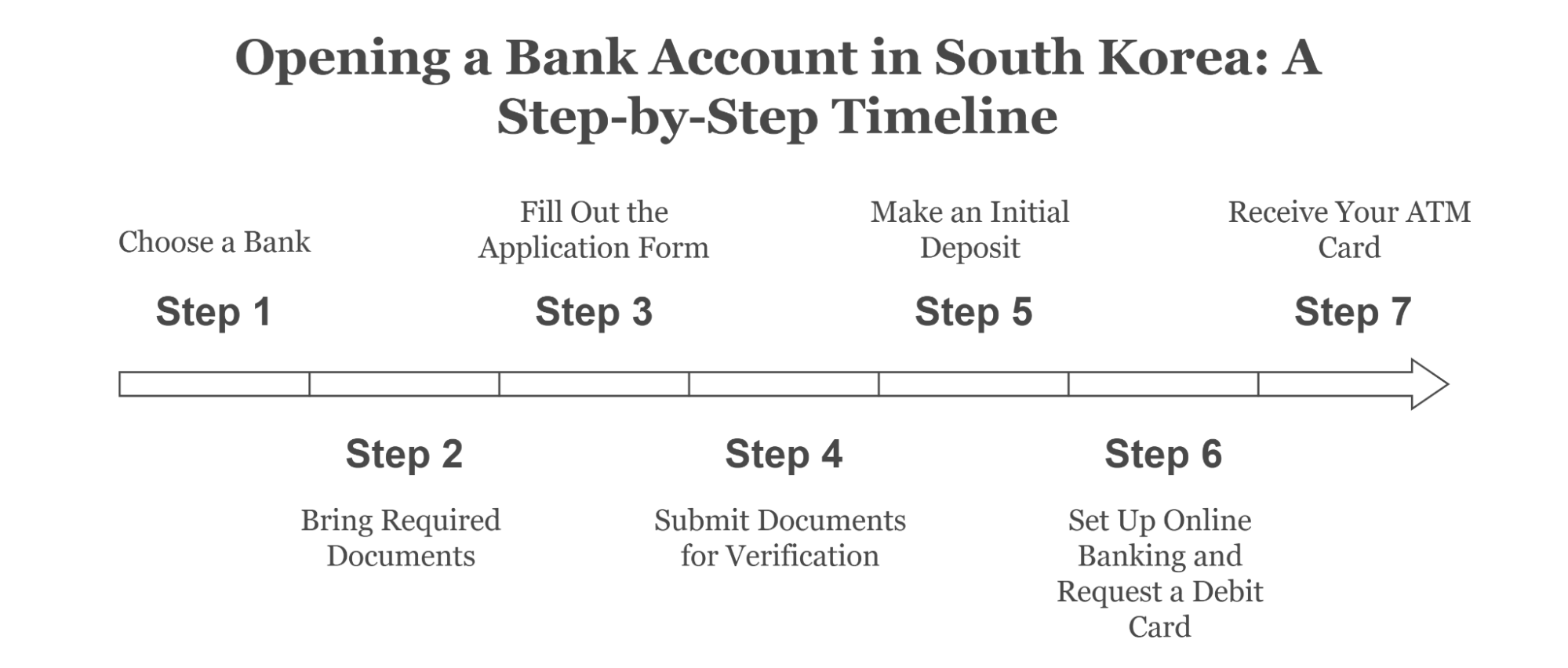

Step-by-Step Guide to Opening a Bank Account

Opening a bank account in South Korea is a simple process if you prepare the necessary documents and choose a suitable bank. Below is a step-by-step guide to help you navigate the process smoothly.

- Choose a Bank:Research different banks and select one that meets your needs, considering factors like English support, international transfer options, and online banking services. Visit a branch that offers services for foreigners.

- Bring Required Documents:Ensure you have all necessary documents, including your passport, Alien Registration Card (ARC), Korean phone number, and proof of residence. If required, bring additional documents like a certificate of employment or student enrollment.

- Fill Out the Application Form:At the bank, request an account application form. Provide accurate personal information and select the type of account you need.

- Submit Documents for Verification:Bank staff will review your documents and verify your identity. Some banks may ask additional questions regarding your purpose for opening the account.

- Make an Initial Deposit:Some banks require a small initial deposit. You should Deposit the amount to activate your account.

- Set Up Online Banking and Request a Debit Card:Request access to mobile and online banking services. You may need to install the bank’s security software and verify your phone number.

- Receive Your ATM Card:Some banks issue ATM cards immediately, while others mail them to your registered address within a few days.

Tips for Successful Bank Account Opening in South Korea

Choosing the right bank, preparing necessary paperwork, and understanding banking fees can help ensure a smooth experience. Below are key tips to help you navigate the account opening process efficiently.

- Choose the Right Bank:Selecting the right bank is crucial, especially for foreigners who may need English support. Major banks like KB Kookmin, Shinhan, and Woori have dedicated services for expatriates, making the process easier. Research their offerings, such as online banking, international remittances, and customer support options, before deciding.

- Prepare the Required Documents:Banks in South Korea require specific documents for account opening. A valid passport is mandatory, and long-term residents also need an Alien Registration Card (ARC). Proof of address, such as a rental contract, is often required, along with a Korean phone number for SMS verification. Some banks may also ask for an initial deposit.

- Visit the Bank in Person:Unlike some countries where accounts can be opened online, South Korean banks generally require foreigners to visit a branch. Bank staff may ask about your residency status, employment details, or the purpose of the account. Having all required documents ready will help speed up the process.

- Understand Account Features and Fees:Every bank has different policies regarding ATM withdrawals, international transfers, and maintenance fees. It's essential to ask about these fees upfront, especially if you plan to send money abroad. If you rely on digital banking, confirm that the bank offers online and mobile banking services in English.

- Set Up Online and Mobile Banking:To avoid unnecessary return visits, register for online banking when you open the account. Many South Korean banks require additional security software for internet banking, so downloading and setting it up right away will save time later.

- Consider International Money Transfer Options:Many South Korean banks impose a waiting period before allowing international transfers. If you need to send money abroad frequently, compare bank fees with alternatives like Wise, Revolut, or PayPal. These services may offer better exchange rates and lower transaction costs.

FAQs

Can a foreigner open a bank account in South Korea?

Yes, foreigners can open a bank account in South Korea. However, requirements vary by bank, and most require in-person visits with specific documents such as a passport, Alien Registration Card (ARC) for long-term residents, and proof of address.

Can I open a bank account without an ARC?

Some banks allow tourists or short-term visitors to open a limited-function bank account using just a passport. However, these accounts may have restrictions, such as no international transfers.

Are there fees associated with maintaining a bank account?

Yes, some banks charge monthly maintenance fees, ATM withdrawal fees, and international transfer fees. It’s important to check the fee structure before opening an account.

Can I send money internationally from my South Korean bank account?

Yes, but many banks impose a waiting period (often three months) before allowing international transfers. Alternatively, services like Wise, Revolut, or PayPal may offer lower fees and faster transfers.

Is online banking available in English?

Some banks, like Shinhan and Woori, offer online and mobile banking in English. However, others may require additional security software, which could be difficult to set up without Korean language skills.

What should I do if I lose my bank card?

If you lose your bank card, immediately contact your bank’s customer service or visit a branch to report the loss and request a replacement. Some banks offer English-language support hotlines.

Can I use my South Korean bank card abroad?

Most South Korean bank cards work abroad, but you need to activate international usage at the bank or via mobile banking. Fees may apply for foreign transactions and ATM withdrawals.

Content Disclaimer: Although this information was last updated in February 2025, we recommend verifying with the appropriate agencies, embassies, and airlines to ensure complete accuracy regarding your travel plans.